Governments’ and households’ budgets – same or different?

In response to some who have asked for a ‘simpler’ version of Dr Bertram’s articles, I offer the following primer.

As this version contains substantial simplifications, there are many relationships, consequences, and options that are not included. My apologies to not only Dr Bertram but also to all my other economics teachers, tutors, lecturers, supervisors, and mentors – for the gross simplifications (and gross generalisations) I convey here. Nevertheless, I hope I capture the essence of the critical information – that government budgets are inherently different to those of a household, as are the distributional and equity consequences of government budget options.

Household, family, or whānau budget

Household budgets are easy. You have two columns. One is your income for the year. The other is your spending for the year. Then you total up both columns. If your total income is greater than your total spending, then the remainder is your savings (which you can then spend the following year).

If, however, your total spending for the year is greater than your total income, then you might choose to review your budget and perhaps trim your spending. You could, also, try to increase your income by working more hours (or, perhaps, a second job).

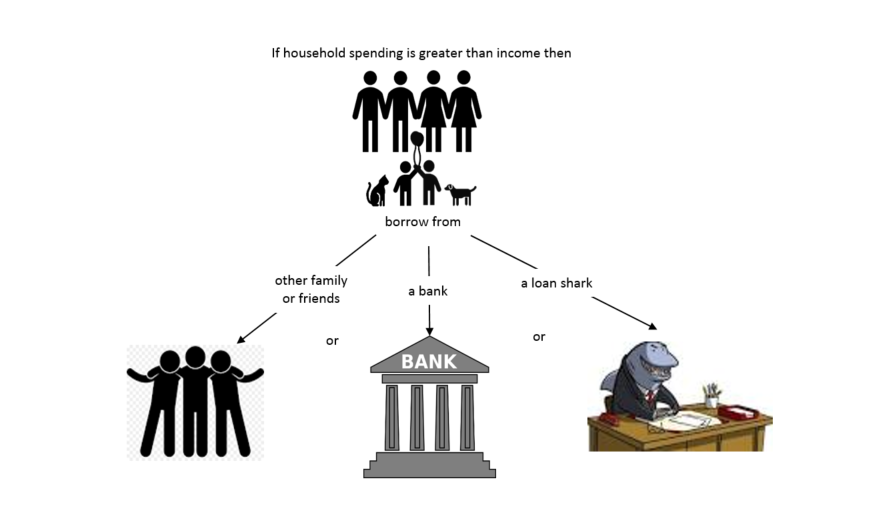

But after all possible reviewing, if you are still left with total spending for the year greater than your total income, then the difference is what you have to borrow. Broadly speaking, you can borrow either from a relative or friend, or a bank, or a loan shark. In this situation, in the following year you will have to figure out a way of repaying that borrowing (your debt). Or, you might face having to borrow even more (and more) and leaving more (and more) debt for your mokopuna to deal with.

Government budget

But for government it is significantly different. Yes, we can start with the same two columns. But thereafter the parallels vanish.

Firstly, the government has more options to control its income and, secondly, the government has more options in terms of who it can borrow from and, importantly, how that borrowing is undertaken.

Take the relatively straight-forward case for starters. If the government’s total income for the year is greater than its spending for the year, the remainder (or surplus) can be put aside as savings (to be spent when the rainy day arrives). Or, the government can give a tax cut and thereby eliminate the surplus.

The other case is where government’s total spending for the year is greater than its total income. Of course, the government (yes, just like your household) could review its budget and choose to increase its income (i.e. increase taxes) or revisit its spending decisions.

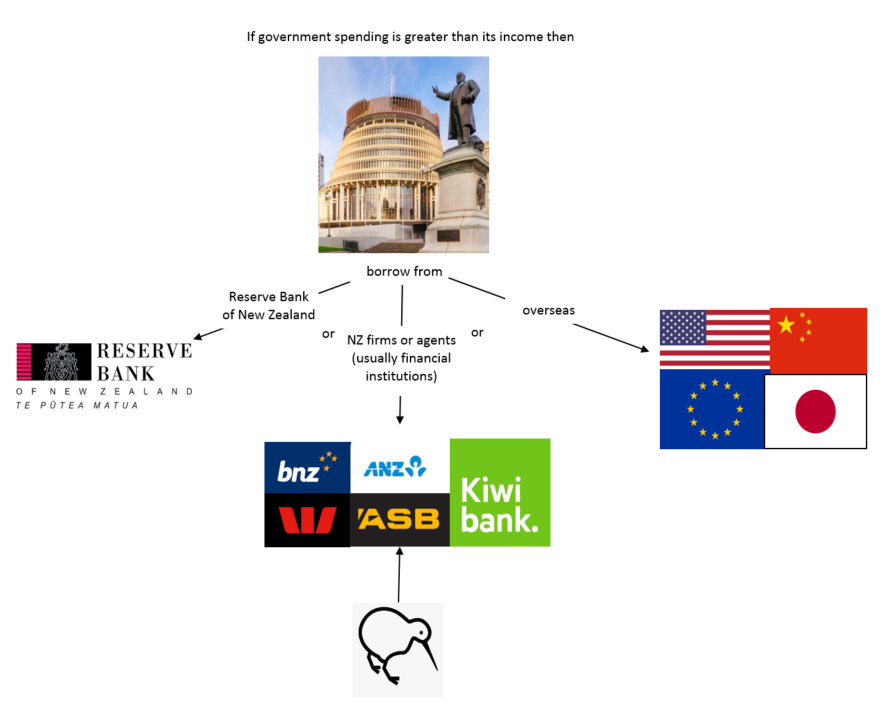

But, again, after such reviews, if spending remains greater than income for the year (say, for example, it needs to implement widespread wage subsidies) then the government has several options for it to make up the difference (the deficit). In particular, the government can:

- Borrow from overseas firms, people, or agents (usually financial institutions)

- Borrow from New Zealand firms, people, or agents (usually financial institutions)

- Borrow from the Reserve Bank (aka “helicopter money”).

Each of these options are described in standard conventional economic textbooks. None are radical in any economic sense. The ‘radical’ label is imposed by political operatives – on the options they don’t like – for their political reasons, not for economic reasons.

Each of these options are described in all standard economic textbooks. There are critical distributional or equity considerations, and these should be front and centre when deciding which option to pursue.

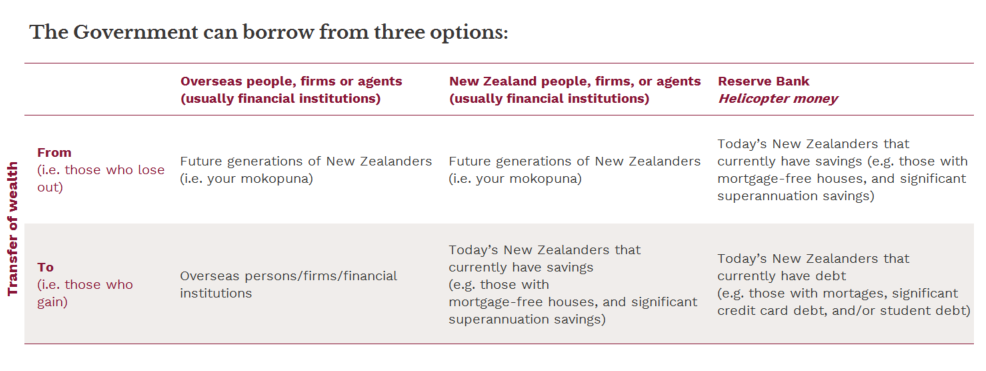

Importantly, each option has different economic implications. Critically, there are stark differences in the implied transfers of wealth between groups in the population that occur under each option. In other words, there are critical distributional or equity considerations (between those who gain and those that lose out), and these should be front and centre to any decision.

Government borrowing - benefits and drawbacks of the options

Borrowing from overseas

Borrowing from overseas is, arguably, the one to avoid at all costs, as it requires future generations of New Zealanders to find (or earn) foreign currency in order to meet both interest and debt repayment obligations. This can lead to increasing foreign influence in (or ownership of) New Zealand firms and assets. In a nutshell, this option involves a transfer of wealth away from future generations of New Zealanders towards overseas interests.

In a nutshell, this option involves a transfer of wealth away from future generations of New Zealanders (your mokopuna) towards overseas interests.

Borrowing from New Zealanders

Borrowing from New Zealand people, firms, or agents (usually financial institutions) is, arguably, more preferable than from overseas. This option still puts a burden on future generations of New Zealanders to bear and repay. However, the difference is that it is domestic currency (i.e. NZ$) that is required to repay this burden. As such, there isn’t a risk of New Zealand firms or assets ending up in foreign hands.

The immediate beneficiaries of this option are the group of today’s generation of New Zealanders who have savings and so are in a position to lend to the government. In effect, this option involves a transfer of wealth away from future generations of New Zealanders towards New Zealanders who currently have savings (for example, those with a mortgage-free house and substantial superannuation savings) that they can lend to the government.

The previous diagram simplifies this situation by assuming that all New Zealanders savings are held by the main banks (financial institutions) in New Zealand. That is, New Zealanders who have savings lend to the government indirectly using New Zealand banks as their ‘agents’ (or the vehicle through which the lending is channelled). Some will note that most of these financial institutions are indeed owned by overseas interests. That is a further complication that I ignore for the purposes of this primer. Just pretend, for the sake of this description, that they are New Zealand banks.

In effect, this option involves a transfer of wealth away from future generations of New Zealanders (your mokopuna) towards New Zealanders who currently have savings that they can lend to the government.

Hence, both of these options favour those who are currently well endowed with savings (either overseas or domestic agents), at the expense of future New Zealanders. Consequently, it comes as little surprise that the above two options are most favoured by institutional financiers who have such savings.

Borrowing from the Reserve Bank (“helicopter money”)

Borrowing from the Reserve Bank is the technical jargon for “helicopter money”. As the Reserve Bank comes within the overall umbrella of the Crown, this is in effect the government borrowing from – and lending to – itself. The government can do this because the government literally controls the amount of currency it can print. It can do this because what we have in New Zealand (as in all modern economies) is a fiat currency – it is not backed by gold, or silver, or property, or any other tangible item. One New Zealand (NZ) dollar is precisely equal to one NZ dollar because the NZ government says (by fiat) it is. Simple as.

Just like the other two options, there are consequences of this option. However, the consequences are considerably different to those of the other two. Printing money potentially reduces the value (purchasing power) of money/currency already in circulation. Hence, those already holding money (i.e. those that already have savings), see an erosion in the value of their savings. That is a reduction in the value of their wealth.

The reduction in purchasing power (the value of currency in terms of the amount of goods and services it can purchase) occurs, arguably, because there is a one-off lift in the level of prices as a result of the increase in the quantity of money in circulation. The presence of this effect (aka the quantity theory of money), as well as its likely magnitude, is heavily contested. But, for argument sake, we concede there will be some lift in prices. However, and importantly, this should not be confused with price inflation, which is an ongoing or continual increase in prices. The impact on inflation of the printing money option is an even more contested area and the subject of considerable conjecture. This topic needs to be tackled outside of this primer.

Conversely, under this option, those New Zealanders that were previously in debt (i.e. had borrowed in previous years and have yet to repay those borrowings) see an effective reduction in the value of that debt. In other words, there is a transfer of wealth from those that currently have savings to those that had previously borrowed. For example, from those with mortgage-free houses, to those with mortgages and no savings.

In other words, there is a transfer of wealth from those that have currently have savings to those that had previously borrowed.

Again, it comes as little surprise that this option is actively lobbied against by institutional financiers wishing to protect the value of their assets. Note, that a large proportion of banks’ assets are mortgages held on New Zealanders’ houses. Conversely, a large proportion of New Zealand households’ debt comprises their mortgage borrowings from banks. So, this printing money option can be seen (admittedly as a gross simplification) as involving a transfer of wealth from New Zealand banks to New Zealand households.

Where does quantitative easing fit in?

Quantitative Easing (QE), as it was first used in other countries during the Global Financial Crisis (GFC), is unrelated to the decisions or options for making up the government budget deficit.

The objective of QE is usually related to a central bank’s efforts to ensure liquidity across (i.e. cash is available to) sectors and also to influence interest rates. At the time of the GFC ensuring liquidity was critical as the crisis had frozen the availability of cash to many sectors.

QE in the GFC case involved a country’s central bank (e.g. The United States Federal Reserve) “printing money” and giving it to private sector businesses (usually financial institutions). Technically, it was a purchase of assets that were on those institutions’ Balance Sheets. But, as those assets were deemed close to worthless due to the market implosion of the GFC, it was effectively a gift to restore the value of those institutions’ Balance Sheets.

The critical difference, for our purposes, is that this QE transferred money to private sector institutions, is for them to decide to spend (or save) as they wish. Many, as it transpired, chose to use this money to pay bonuses to their executives along with share bonus schemes to assist in inflating the price of the assets they own.

Helicopter money (as described above) involves the nation’s central bank “printing money” and giving it to the government to spend as they wish. The two, from both an economic impact and a distributional or equity perspective are as different as chalk is from cheese.

A selection of complicating matters

There are many other considerations within each of the above choices, in addition to those covered in the primer. Most of these considerations are subject to conjecture and argument – both about the magnitude and the direction of the relative impact. This, though, does not suggest any of the three options are any more or less favourable than the others. It does signal that the choice of options to follow requires a careful consideration of the economic situation at the time and the overall objective of the government at the time.

Some of these matters include, that will be covered in explanations in due course:

- The borrowing from overseas option involves transactions in foreign currency. As a result, this option may also have effects on the NZ$ exchange rate. This, in turn, may have potential impacts for the earnings of our exporters and export-related businesses

- Each of the first two borrowing options may increase in interest rates. This is because the government needs to make it reasonably attractive to these savers to lend their funds to the government. This means the government needs to offer them a competitive interest rate return

- Each of the first two options may also divert savings away from what may have been lent to private businesses for their commercial activities

- Borrowing from New Zealanders through New Zealand financial institutions may result in such institutions borrowing from overseas sources to fund their lending to government. They may do this because the interest rate cost of borrowing from overseas is lower than the interest rate return they receive from lending to the New Zealand government. Should this be the case, there are consequences as per the first option, along with potential exchange rate consequences

- The helicopter money option may also cause inflation in the prices of goods and services, which will undoubtedly impact on today’s generation of New Zealanders. Such price inflation though is not guaranteed, and depends on the balance between the level of demands for and the production and delivery of such goods and services. Some argue that the prospect of considerable unemployment and subdued demand for goods and services is unlikely to see accelerating price inflation even in the case of the helicopter money option.