Quarterly Economic Brief – Winter 2025

The Front Pages

The Front Pages

Finding pace on the economic recovery track has not been easy

The wheels keep turning slowly on the economy’s recovery, seemingly slower than anticipated, with growth forecasts revised down. As we surmised in our Autumn 2025 QEB

“All considered, the economic recovery will be supported by lower interest rates, but we expect the pace of the recovery to be more gradual than expected, with a downside risk that it may disappoint near-term.”

Over a quarter later, this is what we see eventuate.

Economic growth has been gradual, at best

The latest release of New Zealand’s official measure of economic growth, gross domestic product (GDP), revealed a second consecutive quarter of positive economic growth at 0.8 percent for the March 2025 quarter. This was largely driven by manufacturing and business services despite seven of the 16 industries measured contracting.

However, these two quarters follow two successive quarters of decline resulting in annual GDP growth of negative 1.1 percent. This comes in at a near five-year low, since the immediate aftermath of COVID-19 in the year to December 2020.

While lower interest rates and official cash rate (OCR) cuts have edged the recovery forward, uncertainty and caution remain, acting as a continued drag. Activity in the month of June disappointed despite growth in the March quarter. On this basis, we have revised some of our near-term forecasts down.

Although tradable inflation and inflation expectations are momentarily up, we do not expect that to remain the case, as spare capacity will contain inflationary pressures. This sentiment is shared by the Reserve Bank of New Zealand (RBNZ) in their 9 July announcement to hold the OCR at 3.25 stating that “with spare productive capacity in the economy and declining domestic inflation pressures, headline inflation is expected to

The decision to hold the OCR at 3.25 came a day after the RBNZ’s own Kiwi-GDP nowcast showed the economy in contraction in the June 2025 quarter. Measures are pointing to an underwhelming recovery in which confidence will strengthen gradually.

The Organisation for Economic Co-operation (OECD) candidly commented in the OECD Economic Outlook for New Zealand for early June:

“…the central bank should steadily reduce the official cash rate to the neutral rate of around 3% and reduce it further if the recovery falters.” (OECD, 2025)

Another consideration for the RBNZ, and a downside risk on our economic recovery, is the effects from the United States (US) imposed tariffs. However, unpredictability persists, and seemingly this has been extended to 1 August. The full impact of these tariffs has not yet come into effect, although some evidence of “front-loading” from US importers to avoid higher tariffs has occurred globally and in New Zealand, with exports to the US up. Despite this context, exports have performed relatively well, benefitting from high global commodity prices for agricultural products.

The proclaimed trade “deals”, notably with China but also Vietnam and the United Kingdom (UK), may provide a level of needed optimism. New Zealand has limited bargaining power in this respect and will be likely to accept the baseline ten percent tariff (if this remains the baseline). While this should not be overlooked, the indirect effects to us will have more wide-reaching impacts, particularly the potential economic impact to trading partners facing higher tariff rates.

We note that the recently passed tax bill in the US will have a partly counteracting effect on the tariffs with substantial stimulus delivered through it. How the inflationary pressure from this stimulus, combined with widespread tariffs, unfolds in the US economy will have important downstream effects for the global economy.

Confidence remains the name of the game

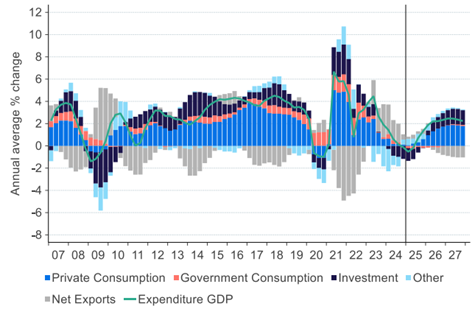

Consumer confidence is returning, albeit from a low mark, bouncing back in the month of June. It is expected that private consumption leads growth in coming years as the strong contribution from net exports fades (see chart below). The roll over of more than half of mortgages will contribute to this, with the option to pin mortgages to lower rates and free up additional spending. Confidence and the pace of further drops in the OCR will, of course, dictate the effects of this.

All other being things equal – our slow and gradual recovery continues

Altogether, there has not been a significant change in the current domestic economic outlook. We have a more gradual recovery than anticipated, and some inflationary risks that we believe will subside (notwithstanding the imposition of tariffs by the US).

The same is true, but perhaps more pronounced, for the global economy – geopolitical relations are fragile, in the midst of a challenge to the “rules-based trading order”.

Stepping back, underlying structural changes, and reflecting on economic forecasting

A common risk and tendency in economic forecasting is missing emerging structural change in how the economy functions, until it becomes apparent that forecasting models should have accounted for them.

This potentially underwhelming recovery should be understood with a broader and longer perspective. The current focus on the pace of the recovery is becoming somewhat myopic in the face of what are likely to be a larger set of underlying and emerging economic factors.

It comes back to the fundamental questions of what are, and what will be, the growth drivers of the economy, how they have been perceived to date, and how much growth can be expected from those drivers, now and in the future.

Example: Housing policy and economic growth

Consider an example of structural change from policy reform. A likely underappreciated reform, in its potential scale and impact, on housing, infrastructure, and local government is being driven by Minister Bishop.

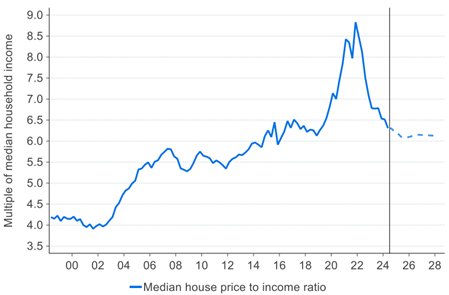

House prices, adjusted for income growth, are already projected to remain flat in the years ahead. They are projected to hover at similar levels experienced since the mid-20202s (see chart below), that is before accounting for the impact of said reforms.

Median house price to income ratio

Is improved housing affordability in coming years a scenario we should seriously consider? What would be the implication for economic growth?

At a recent and revealing Wellington Chamber of Commerce speech, Minister Bishop’s remark that “we would rather an oversupply of houses than an undersupply” went largely unnoticed yet perhaps exemplifies how the Overton Window – the politically accepted subjects and views of discussion - has shifted on the matter.

Circling back to the issue of economic and growth forecasting, the oversimplified explanation that a lower OCR and lower interest rates support economic growth, largely (though not entirely) relies on the intermediate step that an appreciating housing market boosts spending, and the economy, through a wealth effect perceived by homeowners.

But what if house prices gradually respond less to lower interest rates because of supply catching up to the housing demand deficit in the years ahead?

Honest and coherent economic strategy

The housing example is only one out of many technological (AI), demographic (net migration and ageing), geopolitical (changing trading rules-based order) and environmental factors, that are probably already altering how we are accustomed to think about economic growth.

At a time of disappointing economic growth figures, particularly for a government ‘Going for Growth’, the moment seems opportune to honestly assess, and perhaps reconsider, some traditional drivers of economic growth.

To remain serious about economic growth, it is likely that a coherent medium-term economic strategy is required now, setting out the economic growth drivers of today and tomorrow.

BERL economic forecasts

Previous cuts in the OCR have begun to take effect, enabling some levels of activity in the New Zealand economy to return, but the extent of this activity remains low. An economic recovery is underway with downside risks still lingering and hampering confidence. GDP increases in both the December 2024 and March 2025 quarters turned the balance to positive after two successive quarters of decline. Despite this, economic activity remains subdued, and we have revised our GDP forecasts down in this context. We maintain our stance that recovery will be gradual – all other things being equal.

There are some inflationary risks concerning the economy currently, with the imposition of tariffs by the US posing an additional risk. We believe the inflationary risks domestically will subside. Our forecast for the CPI is for it to remain within the RBNZ’s target range for the years ahead but we note risk of price volatility as geopolitical factors unravel. This includes potential energy price shocks and global supply chain disruptions.

Net migration has slumped significantly since 2023 with decreasing numbers of migrant arrivals against increasing numbers of migrant departures – this balance is nearing equal. Most stark is the 70,600 migrant departures of New Zealand citizens in the year ended April 2025 - New Zealand citizens continue to leave the country en masse. This ongoing outflow continues to reflect domestic push factors, such as living and housing costs.

Unemployment has been consistently increasing since late 2021 and reached 5.1 percent in the March 2025 quarter. We expect that this will be its highest point but that it will remain at an elevated level in the years ahead. The key question is where employment growth will come from with declining numbers of migrant arrivals – a historical avenue for supporting employment – and with sustained migrant departures. Retaining and attracting talent is a serious policy concern.

Export growth has remained relatively strong despite the unpredictable and uncertain context surrounding international trade more broadly. Our primary sector has been the driving force in this respect, benefitting from rising global commodity prices. We anticipate export growth to remain minimal but steady, with the tariff shock unlikely to reverse export growth into the negative. A weakening USD will support this but how global supply chains and markets react to tariffs will be the key measure. If global demand slows, or tariffs expand, there are obvious downside risks.

Consumer confidence has shown positive signs recently but still remains quite low and spending activity is cautious in the current environment. Household spending is price sensitive and inflation expectations remain elevated. The weight of New Zealand’s gradual economic recovery will continue to put downward pressure on import growth and our forecasts reflect this. We expect very minimal growth in imports over our forecast period primarily through generally lower consumer demand.

Despite austerity measures and fiscal responsibility, the 2025 Budget Economic and Fiscal Update forecast OBEGAL widening to $10.2 billion in the year ending June, before again expanding to $12.1 billion in 2026. We maintain a more sceptic view of this and anticipate debt coming in at slightly above these forecasts.

BERL Forecasts

2023 | 2024 | 2025 | 2026 | 2027 | |

Actual | Actual | Forecast | Forecast | Forecast | |

| GDP (production) | 3 | 0.6 | 0.3 | 1.8 | 2.2 |

| Employment rate | 69.8 | 68.3 | 67.2 | 67.6 | 68.0 |

| Unemployment rate | 3.6 | 4.6 | 5.1 | 5.0 | 4.7 |

| Net migration | 108,582 | 67,800 | 14,000 | 22,300 | 31,900 |

| CPI | 6 | 3.3 | 2.7 | 2.0 | 2.2 |

| Exports growth | 12.2 | -5.6 | 2.5 | 3.0 | 2.0 |

| Imports growth | 3 | -12.1 | 1.5 | 2.1 | 3.0 |

| OBEGAL ($ billions) | -9.4 | -8.8 | -15 | -13.1 | -11 |

All percentage growth rates are annual. Years are to June.

We have simplified the contents of our forecast data tables to focus on a selection of key variables. If you would like to obtain forecasts of other variables not shown, please email [email protected] or phone +64 21 868 190.