On Tuesday morning (NZ time) the Trump administration announced further tariffs in the escalating trade war between the world’s two biggest economies. China has stated they intend to impose retaliatory tariffs on U.S. goods.

The latest targets are Chinese manufactured consumer goods ranging from bicycles to handbags worth US$16 billion, equal to nearly 40 percent of goods China sold the United States last year. The new tariffs will come into effect next week, starting at 10 percent and rising to 25 percent from January 1. These are in addition to those already imposed on $50 billion in Chinese imports.

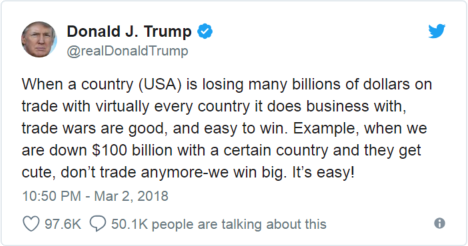

Trump initiated the fight to punish Beijing for what he says are China’s predatory tactics to try to supplant U.S. technological supremacy. Despite this approach being far removed from the traditional values of the Republican Party, Trump can claim a mandate for this action. After all he certainly addressed the topic of trade with China in many of his campaign speeches, and this latest round of tariffs were decided on after a period of public consultation.

All this raises the question, will the actions result in the outcome the Trump administration is seeking?

Historically this kind of tit for tat trade war doesn’t work out well for either side. Protectionism reduces trade which reduces the market for a country’s exports and this can lead to lower incomes. The problem extends beyond China, Trump’s tariffs on imports of aluminium and steel have prompted retaliatory trade tariffs from Mexico, Canada and the EU. That’s a list of the USA’s top four trading partners.

American farmers are already feeling the pinch despite making US$12 billion in compensation payments. This federal relief package is itself receiving considerable criticism as an obvious case of corporate welfare, and it’s a short term measure for what is likely to be a long term problem – unless the President has a sudden change of heart.

Today the Wall Street Journal is reporting that Lawrence Kudlow, head of the White House National Economic Council is blaming China for the international trade situation and previous administrations for the domestic situation. He is quoted as saying “Do not blame Trump for this. He inherited this mess.” In his view the massive US government budget deficits are a function of too much government spending, and not due to tax cuts.

Many large American companies have significant investments in manufacturing overseas, for them this trade war is bad news. Supporters argue that they should respond by shifting manufacturing to the US, creating jobs for the people in the US. This cannot happen quickly, and Trump’s style of government has introduced massive uncertainty and risk which will scare away thoughts of major investment in the US. Even if production could be shifted this could undoubtedly result in higher prices both to recover the cost of the move and in higher wages demanded by American workers.

Classic American icon Harley-Davidson provides an example. When meeting with Harley-Davidson executives at the White House soon after his inauguration Trump said that his policies would breed success for the company and make the United States the “best country on Earth to do business”. In January Harley-Davidson announced plans to close its Kansas City plant, they are already building a new facility in Thailand. However they are benefitting from tax reform which reduced the corporate tax rate from 35 percent to 21 percent.

Higher prices of imports combined with the currently strongly growing economy is likely to result in inflation pressure, which the Fed may then try to control with interest rate increases. Sooner or later this adds up to bad news for the American economy and the workers in it. Those who were hoping Trump would create a job for them are likely to be disappointed. The irony would be amusing if it didn’t affect the livelihoods of so many, whether they voted for the president or not.

All of this doesn’t much benefit New Zealand either. Short-term there is potentially some upside if producers here can replace some of the American products in China. In the long run if the US economy suffers we will feel the flow on effects. Our application for an exemption to the aluminium and steel tariffs was declined, and there’s no knowing how long they will be in place or what might happen next.

Our relationship with China is good, they are our largest export market, boosted by the Free Trade Agreement we signed in 2008. The current government is negotiating an upgrade to that FTA which will further expand opportunities for New Zealand exporters.