Quarterly Economic Brief – Autumn 2025

2025 is expected to be the year the economy turns a corner. Geopolitical tensions and evolving trade policies could delay or alter this turnaround.

The first quarter of 2025 was decidedly volatile as the Trump administration implemented its campaign platform, including its trade policy and tariffs. At home, the long expected economic recovery, although gradual, has started.

We do not expect the recovery to be totally thrown off course by the United States (US) economic and foreign policy, although a US economic recession cannot be dismissed outright. As the Trump administration unveils a more protectionist stance than expected the risk to the economic outlook is to the downside.

New Zealand is impacted through three channels: the direct channel, our US exports market affected by tariffs; the indirect channel, as the impact of tariffs ripples through global supply chains, including our main trading partner China; and the ‘confidence’ channel, the less tangible and measurable but consequential impact on business and household spending and investment plans.

The remaining factors affecting the outlook for 2025 are the government’s fiscal policy and Budget 2025, and the Reserve Bank of New Zealand’s (RBNZ) monetary policy and official cash rate (OCR) for the year. Again, our base case is that both fiscal (returning to surplus and conservative budgets) and monetary (OCR reducing to about three percent) paths for 2025 will not be meaningfully altered by the incoming Trump administration (yet). But a weakening US and global economy must figure as a likely economic scenarios, although this is somewhat dependent on what size tax cuts Trump gets through US Congress later in the year.

A recovering New Zealand economy weathering a fragmenting global economic order.

Gross domestic product (GDP) growth for December 2024 surprised to the upside, signalling the beginning of an economic recovery cycle. But much has happened since.

While the direct impact of US tariffs will certainly be meaningful on exports affected, the broader impact on the economy will be relatively contained, including when our weakening exchange rate is taken into account. The larger concern is the ripple effects through the global economy back to us (through China in particular), and the resulting impact on domestic business and household confidence.

China is grappling with a structural economic slowdown of its own since COVID-19, and given the how interconnected the Chinese economy is with the world, further slowing will amplify the effect of the US tariffs. China is exporting its way out of its slowdown, and the Europeans are wary of a wave of cheap Chinese products flooding their markets diverted away from the US.

The worst-case scenario is an all-out global trade war. But the situation is fast-evolving and unpredictable, with policy shifts and reversals. At the very minimum, the global economic order has been unequivocally upended.

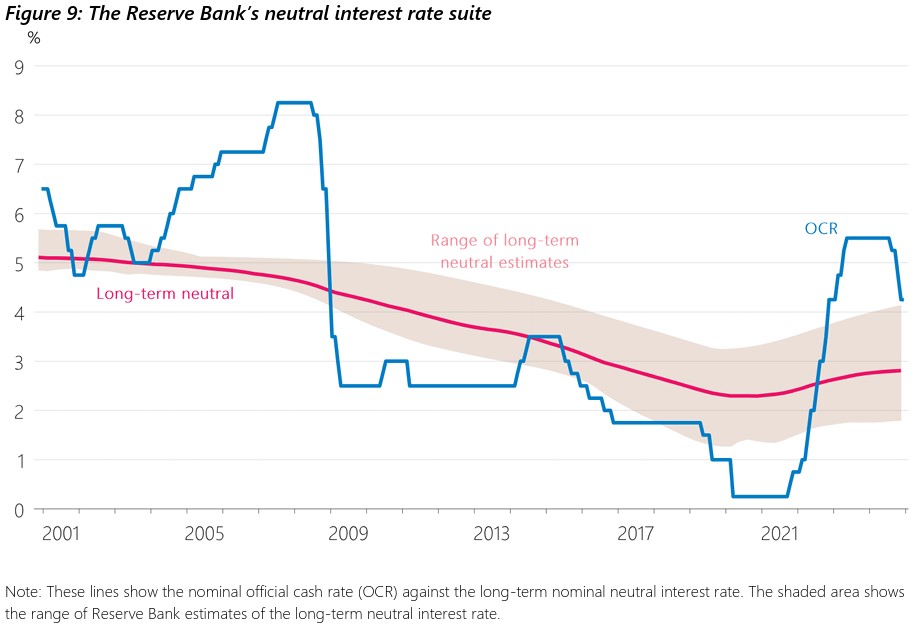

2025 is expected to see the end of the RBNZ’s cutting cycle, with a consensus view that the OCR will be reduced to about three percent. Inflation is expected to stay close to the two percent target, notwithstanding the evolving risks to the global economy. The RBNZ will take a balanced, data-dependent, and flexible approach to cutting the OCR over the coming year.

The monetary policy question for 2025 will be whether the RBNZ is keeping interest rates higher than they need to. The unsettled debate around what the neutral interest rate is, the rate at which monetary policy is neither constraining nor supporting the economy, is going to persist.

The OCR is currently sitting at the top end of the RBNZ’s estimated band for the neutral rate, and the Bank will be vigilant in retaining a tighter than needed stance on the economy. Ultimately, the neutral rate is not known with precision, particularly given the current international context.

All considered, the economic recovery will be supported by lower interest rates, but we expect the pace of the recovery to be more gradual than expected, with a downside risk that it may disappoint near-term.

Longer-term, the unavoidable question is how New Zealand, as a small open economy, positions itself in a fragmenting global economic order. The Prime Minister laid out a blueprint at a speech to the Wellington Chamber of Commerce recently, emphasising the importance of free trade and leveraging and expanding free trade agreements (The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in particular) with like-minded partners.

The US economy is on a much less certain path. The consensus is building around a slowdown in 2025, with recession risks rising.

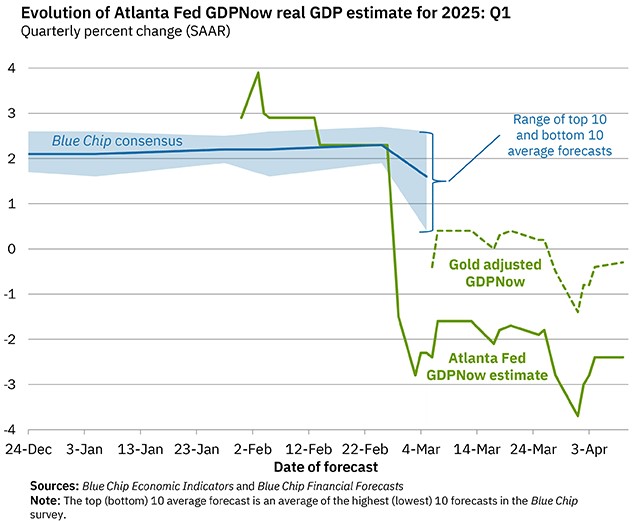

The US economy generally leads the global economic cycle. Forecasts for the US economy are being cut, as shown by the blue line below. At the same time, real time GDP indicators for the US economy have fallen off in the last few weeks although exaggerated by large recent import volumes of gold into the US, arguably to front run said tariffs. Still, the direction is unmistakable, the US economy is slowing down, with recession risks rising.

As result, waning expectations for the US economy have weakened the US dollar since January and Trump’s inauguration. A US economy slowdown will flow-on to other economies, but a weaker US dollar and lower interest rates, although both these indicators are still volatile, would provide some countervailing relief to the global economy.

Confidence and sentiment in the New Zealand economy is what needs protecting and restoring.

The challenge to the economic rules-based order posed by the Trump administration is disruptive, but not fatal, to our near-term economic recovery.

It does, however, render the pace and stability of this recovery less certain, and raises longer term questions for our economic and trade policy and strategy. The less tangible and measurable, yet consequential, impact is on household sentiment and business confidence across the New Zealand economy.

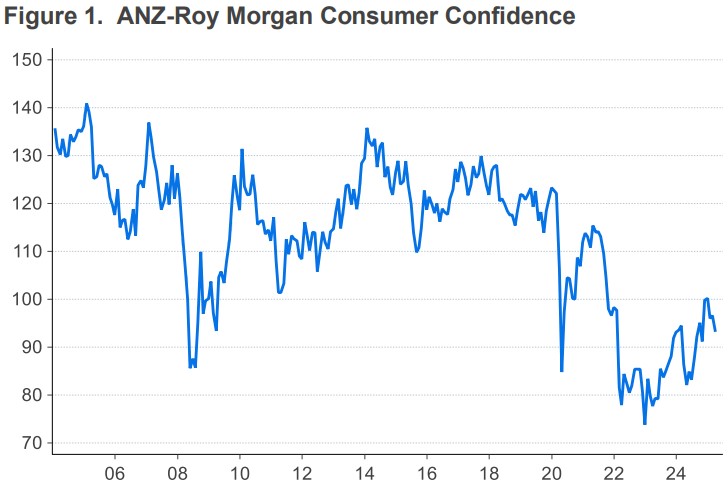

Consumer confidence is recovering, but gradually and from historic lows. Taking a long-term view (see figure below), it remains weak and vulnerable to shocks, including international ones.

Uncertainty begets uncertainty, and economic confidence is broader than direct economic and commercial links. Business investment is catalysed by certainty and predictability, while household spending varies with wealth effects.

For instance, New Zealand households have increased their exposure to US financial markets, driven by more accessible passive investment products (such as exchange-traded funds, ETFs) and buoyant asset prices in large US technology stocks. But US markets have corrected over the past weeks and days.

What can we do? Economic policy coordination and sophistication is in our control

Evidently, diplomatic efforts are part of the solution.

However, domestically, and regarding economic policy specifically, the coherence of the macroeconomic policy framework, the interaction between monetary and fiscal policy, and how it weathers uncertainty and volatility, will be important to foster New Zealand household and business confidence.

The Beehive and the RBNZ must be clear on their respective roles, and act in a coordinated fashion while remaining independent.

The RBNZ will be vigilant to the risk of remaining tight relative to the economic neutral rate, while the government will be weighing competing fiscal policy objectives. These include consolidation through achieving a surplus, attracting foreign investment (including through potential tax policy changes), and supporting confidence and the economy through this period.

Effective interaction and complementarity in the path, timing, and direction of our monetary and fiscal policies over 2025, given the heightened level of uncertainty and volatility at present, would provide a welcome anchor of predictability and certainty for households and businesses.