Inequality and New Zealand

Introduction

It’s time to take a good look at inequality in Aotearoa New Zealand.

As part of BERL’s pro-bono research programme, we're taking a deep-dive into the types and effects of inequality in New Zealand. Outcomes of inequality aren’t seen by many New Zealanders, but that doesn’t mean they aren’t there. For this study, we are looking to build on the kōrero around inequality in New Zealand, and work with experts that have seen the effects inequality has on New Zealand, particularly on tamariki.

We know we cannot ‘solve inequality’ overnight, but by listening to the whakāro of experts we intend to unpack challenges, and highlight the opportunities for New Zealand in seeking to address inequality.

Income is just the start for inequality

Why inequality matters for everyone

Inequality can be a philosophical debate, some level of inequality is unavoidable, but it can often become a significant problem. Inequality matters because it often is associated with poor long-term social outcomes. Everyone, including the very wealthy pay the costs of these poor outcomes, and reducing inequality can be beneficial for us all.

If inequality can be a barrier to participating fully in New Zealand, then reducing these barriers creates a huge opportunity for New Zealand. Reducing inequality is not about any one characteristic as many intergenerational factors can play a role in creating barriers to opportunities.

This chapter considers inequality in terms of the four capitals of The Treasury’s Living Standards Framework.

Financial inequality (financial capital)

Income and wealth inequality are the most obvious influences on intergenerational transfers. As seen in recent years with the New Zealand housing market, the home ownership dreams of many potential first-home buyers depend on the equity supplied by their parents.

Wealth for housing is only the tip of the iceberg. Housing plays a significant role in wealth inequality. As it is often the largest asset for families that own a home, housing plays a significant role in the wealth discrepancy.

Income and wealth also play a role in the ability of tamariki to participate in employment. Similarly, housing wealth is often used to start a small businesses, giving a significant advantage to individuals who own a home. This ability to raise finance against a home also gives these businesses more resilience in the critical early stages of business growth, with a larger buffer to weather economic shocks.

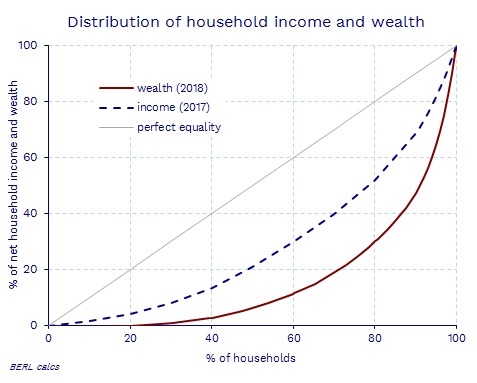

In New Zealand, 70 percent of household wealth was held by just 20 percent of New Zealand’s households as shown in Figure 1. For the first quintile, i.e. lowest level of the wealth distribution, the average household has a negative net worth, where they have more liabilities than assets.

Inequality of education (human capital)

The 2020 UNICEF Innocenti Report Card begins by stating that “in the world’s richest countries, some children do worse at school than others because of circumstances beyond their control, such as where they were born, the language they speak or their parents’ occupations. These children enter the education system at a disadvantage and can drop further behind if educational policies and practices reinforce rather than reduce the gap between them and their peers.” Inequalities that exist at this stage influence and limit children’s prospects as adults.

Parental education is a strong predictor of educational attainment of students. Being the first person in your family to go to tertiary education is daunting, particularly if it involves moving away from your family and social networks. This can lead to individuals missing out on their educational potential, which may have long-term or even intergenerational effects on income, education, and wealth.

The outcomes of higher education also link back to wealth. The median net wealth of individuals with no qualification is just $50,000, compared with more than $150,000 for individuals with a level four to six qualification. Post graduate qualification holders have a median net worth of more than $200,000. Having strong intergenerational qualification rates can make a circular intergenerational link between qualifications and wealth.

New Zealand performs poorly when compared to the countries that make up the Organisation for Economic Co-operation and Development (OECD). The 2020 UNICEF Innocenti Report Card shows New Zealand has room for improvement in all of the education measures.

The estimated percentage of children aged 15 years who have basic proficiency in both reading and mathematics was just 65 percent. This ranks New Zealand 17th of the 39 countries where data was available. Where we see inequality of education showing up is in the percentage of 15-year-olds who have reached basic proficiency in reading and mathematics, according to whether or not there were books at home to help with schoolwork. Approximately 77 percent of 15-year-olds with books in the home to help with school work have reached basic proficiency in reading and mathematics compared to just 60 percent who do not.

Inequality of connections (social capital)

Parental connections can play a significant role in providing employment opportunities, and can provide a shoe in the door for entry-level employment positions. This effect can even be as simple as the geographic location of your birth. Being in a community with a very narrow range of employment opportunities can create a narrow view of what employment options are available.

When I was young, I expected to grow up to be an accountant, because my father was an accountant. Fortunately, I managed to avoid this intergenerational nudge, but some may suggest (incorrectly of course), that economics is not too far from the tree.

Another example includes a parent who is a business leader who can use their position or industry connections to help family members’ access opportunities. These are opportunities that may not have been available without the connection. This gives the family member a step up at an early stage of their career that continues to benefit the family member throughout their career.

Inequality of environment (natural capital)

We are also facing the prospect of future generations paying for the environmental decisions of today. This is a form of generational inequality that will affect everyone in the future. This is a large area and is being considered in a separate piece of research by my colleague Hannah Riley.

Why inequality matters for growth

Those who believe inequality is good, or at least necessary, for economic growth will argue that it provides an incentive to entrepreneurs and investors to take the chances and risks necessary to create growth. However, as inequality has grown across the world a growing body of evidence has emerged showing that societies with greater levels of inequality fail to maximise wellbeing and economic growth. These societies are less functional, less cohesive and less economically sound than societies with greater levels of equality.

Well tested international evidence shows that beyond a certain point increasing national growth as measured by Gross Domestic Product (GDP) does not improve the quality of life in a society, but greater equality does. Research from the Organisation for Economic Co-operation and Development (OECD) shows that when inequality rises, economic growth falls.

The dominant view is that inequality is not an outcome of growth, but plays a role in determining the pattern of growth and poverty reduction. New Zealand’s economic growth and economic development does not have to be at the expense of increasing inequality.

Studies from the OECD, International Monetary Fund (IMF), World Bank and others have shown that reducing inequality can contribute to boosting economic growth and reducing poverty, while at the same time improving access to opportunities and increasing wellbeing across a range of indicators.

In this chapter we look at the relationship between inequality and growth. In our next two chapters we focus on the relationship between inequality and wellbeing.

Inequality, poverty and growth

Inequality and poverty affect each other directly and indirectly through their link to economic growth as measured by GDP. The links between inequality, growth and poverty cause direct and indirect impacts on each other as well as overall wellbeing. Reducing inequality can promote growth and reduce poverty which in turn improves wellbeing.

The argument for inequality is that it drives innovation and provides an incentive for people to invest. Investors can take risks knowing there is the possibility of significant rewards if they are successful. Another argument for inequality comes from those who believe that the best way to grow the economy is to have the market decide.

The argument against taking measures to reduce inequality, is that it takes money away from those who can use it to invest most efficiently. Thus redistributing income or wealth to reduce inequality reduces economic efficiency and hampers growth.

However, studies in the last 30 years have found evidence that once inequality reaches a certain point it becomes bad for growth. Research from the OECD indicates that reducing inequality can actually boost economic growth.

OECD analysis from 2014 suggests that income inequality has a negative and statistically significant impact on medium-term growth. The OECD found that rising inequality by three Gini co-efficient points would drag down economic growth by 0.35 percentage points per year for 25 years. Resulting in a cumulated loss of GDP at the end of the period of 8.5 percent.

Growing inequality from 1985 to 2005 cost New Zealand 13 percent economic growth by 2010 - OECD.

An example produced by the Economists Resource Centre for the United Kingdom Department for International Development modelled what would happen if the share of gross national income going to the lowest 20 percent of the population increased from six percent to 6.25 percent. Although the Gini co-efficient would remain largely unchanged for these 20 percent of households it is a four percent increase in their incomes. This small redistribution would have the same impact on poverty reduction as doubling the annual growth of national income from four percent to eight percent.

Britain’s Equality Trust has estimated the costs of inequality in the United Kingdom, including reduced life expectancy, worse mental health, and higher levels of imprisonment at £39 billion per year or about 1.8 percent of GDP. The Salvation Army have calculated that for New Zealand it would equate to around $5.4 billion per year.

Recent studies have suggested the reason for this high cost of inequality is an inability of those at the bottom end of the wealth and income scales to invest in themselves. When faced with decisions on where to spend money households in poverty often face a choice between essentials. While many families in poverty would like to grow their skills for many simply affording the basic necessities makes spending on education and training a low priority. If a young person leaves school and goes to work at age 15 to support a household this prevents that young person from progressing their education. For many the decision at this age will impact the rest of their lives.

This leads to a reduction of the potential for these people to access the skills businesses require. This in turn reduces the opportunities for these individuals to access higher paying jobs which would allow them to move out of poverty and become the investors, innovators and risk takers that drive economic growth.

The argument put forward by some is that if everyone is given the same opportunities and works hard, then everyone has the same opportunity to achieve. This is simply not the case for those whose financial situation does not allow them the opportunity to further their education and invest in themselves.

The impact of inequality on growth stretches well beyond education. IMF research has found that inequality can lead to social unrest which in turn causes a reduction in economic confidence that can deter investment.

In some situations social divisions fuelled by inequality can also make it difficult for government to find the necessary consensus to make policy changes. This becomes particularly true when facing economic downturn such as one induced by COVID-19.

Money also buys access and influence. Those with money can use it to get access to those in power. We have seen the influence that industry groups can have to ensure that their members have influence on government policy. While this isn’t as noticeable in New Zealand as in other countries it still exists. The influence the wealthy have on policy and decision makers can lead to decisions that benefit particular groups at the expense of the economy as a whole. Some may argue that the decision not to implement a capital gains tax was a political decision that benefitted an influential voting bloc.

The World Bank World Development Report 2000/2001: Attacking poverty concluded that better distribution of income is possible without a reduction in economic growth. There is no trade-off between efficiency and growth. Lower inequality benefits the poor in two ways’ increasing growth and increasing average incomes.

What is clear is that as New Zealand recovers there does not need to be a trade-off between reducing inequality and economic growth. They are interconnected. If New Zealand can address inequality we can provide an additional boost to our economy at no extra cost.

Why inequality matters for wellbeing (part one)

In the previous chapter we focused on why inequality matters for growth. However, there is more to societal success than just gross domestic product (GDP) growth. This chapter is the first of two that looks beyond economic growth to examine the important relationship between inequality and wellbeing.

As inequality has grown across the world a body of evidence has emerged showing that societies with greater levels of inequality fail to maximise wellbeing. They are less functional, less cohesive and less economically sound than those societies with greater levels of equality.

Well tested international evidence shows that beyond a certain point increasing national growth as measured by GDP does not improve the quality of life in a society, but greater equality does.

As noted in the earlier chapter, the dominant view is that inequality is not an outcome of growth, but plays a role in determining the pattern of growth and poverty reduction. New Zealand’s economic growth and economic development does not have to be at the cost of increasing inequality.

Studies from the Organisation for Economic Co-operation and Development (OECD), International Monetary Fund (IMF), World Bank and others have shown that reducing inequality can contribute to reducing poverty, improving access to opportunities and increasing the wellbeing across a range of indicators.

Tackling inequality can make societies fairer and economies stronger resulting in an overall improvement in wellbeing. The IMF report Humanity Divided: Confronting inequality in Developing Countries looked at why national inequality matters. The report states that “unequivocally, the speed – and cost – of income poverty reduction are directly related to the prevailing level and direction of inequality. This implies that, if the objective is to reduce poverty or at least raise incomes of the poor, there is a need to track and intervene with policies to manage inequality in order to maximise rising average incomes and raising incomes of the poor.”

The United Kingdom Centre for Labour and Social Studies (CLASS) identified that beyond a certain point national income does not improve the quality of life in society, but greater equality does. CLASS found that although lower income households are impacted hardest, inequality harms us all no matter wealth or income. As CLASS wrote in their report “greater inequality seems to lead to a general social dysfunction”

The following are just a few of the areas where research has shown that reducing inequality can have a positive impact on wellbeing.

Social mobility and education

The availability and ease of social mobility is particularly important in societies with high inequality. It provides opportunities for those currently in poverty to gain access to a higher quality of life. In contrast, persistent deprivation is a symptom of a lack of social mobility, where people currently facing poverty remain in a similar situation in the long term, restricting their ability to make the most of their life chances.

Many people are of the opinion that everyone has the same opportunities to succeed and inequality does not matter. A common misconception is that poorer individuals can improve their position by simply working harder. However, evidence suggests that social mobility is lower in unequal societies.

As Class reported, Norway, Denmark and Sweden have some of the highest rates of social mobility and are amongst the most equal developed nations.

As discussed in our previous chapter, education is a major factor in people improving their personal circumstances. Max Rashbrooke notes in his book Inequality: A New Zealand crisis, that when people have hugely different incomes, they have different opportunities and that these can persist through generations. The book identifies that children from high income families typically go to better equipped schools than children from low income families. Taking this further, children from higher income households also have greater opportunities to stay in school and progress to further tertiary or trades training.

Across OECD countries, income inequality is negatively associated with average educational attainment. Analysis based on micro data from the OECD Adult Skills Survey shows that increased income disparities depress skills development among individuals with poorer parental education backgrounds, both in terms of the quantity of education, and its quality. Educational outcomes of individuals from richer backgrounds, however, are not affected by inequality. OECD evidence also shows that the wider income inequality is, the lower the chance that low income households invest in education.

New Zealand performs poorly compared to other OECD countries. The 2020 OECD Innocenti Report Card shows New Zealand has room for improvement across all the education measures. The estimated percentage of children aged 15 years who have basic proficiency in both reading and mathematics was just 65 percent. This ranks New Zealand 17th of the 39 countries where data was available. New Zealand ranked above Australia, the United States and the United Kingdom which all have greater income inequality (as measured by the Gini co-efficient). However, with the exception of South Korea the top ten countries with proficiency in both reading and mathematics had lower levels of income inequality than New Zealand.

New Zealand’s inequality of education shows up in the percentage of 15-year-olds who have reached basic proficiency in reading and mathematics, according to whether or not there were books at home to help with schoolwork. Approximately 77 percent of 15-year-olds who have books in the home to help with school work have reached basic proficiency in reading and mathematics compared to just 60 percent who do not.

This has been highlighted by COVID-19. Manurewa High School principal Pete Jones said between 10 and 20 percent of the school’s year 12 and 13 students got jobs during lockdown and may not return to school. Families in the school community had suffered job losses meaning a teenager’s wages might now be a big part of the household income. With young people forced to work to support families this limits the opportunity for them to improve their social standing by taking advantage of what many see as ‘equal’ opportunities for everyone.

A 2007 study from the Ministry of Social Development addressing the question ‘How Does Investment in Tertiary Education Improve Outcomes for New Zealanders?’ found a strong association between the attainment of tertiary qualifications and higher incomes. Those holding a bachelor's degree or higher qualifications had hourly earnings that were 64 percent higher than those with no qualifications. Incomes were also 29 percent higher for those with "other tertiary" qualifications and six percent higher for those with school qualifications.

The Education and earnings a New Zealand update study from the Ministry of Education released in June 2020 found that degree and higher-level education gives people a higher annual earnings as well as higher earnings growth. Nine years after leaving school, those with a degree or higher-level education can expect to earn 15 to 20 percent more than someone of the same age who finished their education with University Entrance and 40 to 50 percent more than someone who finished with NCEA Level 2.

Health

Recent media reports from home and abroad highlight the disproportionate impact COVID-19 has had on low income households. In its report released prior to COVID-19 CLASS found over 200 studies linking the relationship between income inequality and health. The findings from these studies show that life expectancy, infant death rates, low birth weights, obesity and mental health were all shown to be worse in unequal societies.

Inequality.org, part of United States think tank the Institute for Policy Studies, states that “Poor health and poverty do go hand-in-hand. But high levels of inequality, the epidemiological research shows, negatively affect the health of even the affluent, mainly because, researchers contend, inequality reduces social cohesion, a dynamic that leads to more stress, fear, and insecurity for everyone.”

This is also the case for New Zealand. In 2006, research by MOTU argued that increased income inequality induces household crowding, which in turn leads to increased rates of infectious diseases. MOTU’s results provide support for a differential impact of income inequality and inadequate housing on rates of hospital admissions for infectious diseases among children.

In its 2016 Inequality and health policy statement The Public Health Association of New Zealand (PHA) identified that health inequalities are the result of differential access to the conditions for a healthy life including sufficient income and wealth, adequate healthcare and a healthy environment. The PHA quoted Margaret Whitehead of the World Health Organisation who said that differences in health between groups are “caused by unequal distribution of income, goods and services and the consequent chance of leading a flourishing life.”

Social mobility and education and health are just two of the areas impacted by wellbeing. In Why inequality matters for wellbeing (part two) we will examine the impact inequality has on child welfare, crime and punishment and trust and community.

Why inequality matters for wellbeing (part two)

In our previous chapter we introduced why inequality mattered for wellbeing and examined the impact inequality has on social mobility and education as well as health. In part two we continue our look at the impact inequality has on wellbeing with a focus on the impacts of inequality on child welfare, crime and punishment and trust and community.

Child welfare

Related to health is the impact that inequality and child poverty have on outcomes for children. Bad health outcomes include poor oral health, poor cardiovascular health and poor physical health. In its policy statement the PHA identifies research from a number of sources that shows people living in deprived areas are more likely to exhibit risk factors associated with poor health. Low-income households are more likely to live in substandard housing, impacting respiratory health as well as increasing the chances of infectious disease.

In a 2008 report for the Children’s Commissioner and Barnardos Michael Fletcher and Máire Dwyer looked at the impact growing inequality had on child poverty. Fletcher and Dwyer found that child poverty rates rose sharply in the late 1980s and the early 1990s. During this period, inequality rose more in New Zealand than in any of the 20 OECD countries for which comparable data is available. The key drivers were low wage growth for many working families, high unemployment and reductions in welfare payments. The authors make it clear that reducing child poverty through reducing inequality, is something that should be important for all New Zealanders.

The authors stated that “Ending child poverty means ensuring children have access to enough food, clothing, adequate shelter, and health care and the learning experiences and opportunities to develop to their full potential. While parents and caregivers have a primary responsibility, they need financial and other support to equip them to provide these essentials for their children. We all benefit from the healthy development of New Zealand children. Similarly, we will all pay the price for getting it wrong.”

Crime and punishment

More equal societies there have less crime and they punish less severely. The United Kingdom Centre for Labour and Social Studies (CLASS) identifies 40 studies that demonstrate this. Inequality is associated with crime because it is linked to poverty. Areas with high inequality tend to have high poverty rates. Research by the Salvation Army found that international studies have shown that among wealthy, developed countries like New Zealand, the more unequal countries also have higher homicide and imprisonment rates. The social division created by high levels of inequality lead to less empathy and a greater willingness to punish people.

There are different patterns between property and violent crime. In a study for the University College Dublin Morgan Kelly found that property crime is largely unaffected by inequality, but significantly influenced by poverty and police activity. Violent crime is little affected by poverty and police activity but strongly aggravated by inequality.

A study published in 2014 from the University of Oklahoma and at the University of California demonstrated that over a 20-year period, the American states that had the greatest inequality in visible expenditure spending on items such as clothing, jewellery, cars, and eating out also suffered the most from violent crime.

Referencing the Inequality Trust Paul Barber in the Salvation Army Progress towards equality report finds the link between crime and punishment and inequality holds across different cultures, contexts and research methods.

In New Zealand research shows that other crimes, including family violence or youth crime, are linked to poverty and inequalities. In response to a former Police Minister’s comments in 2016 dismissing poverty as a 'driver' of crime and linking crime problems primarily to 'a lack of responsibility’, Victoria University of Wellington Director of the Institute of Criminology, Dr Elizabeth Stanley wrote an article addressing poverty and crime, commenting that the crimes we label, police, control and punish tend to be committed by those who endure significant economic disadvantage.

This view was further supported by the Children’s Commissioner Andrew Becroft in response to a Ministry of Social Development report showing that within nine months, babies living with material hardship are angrier and react badly to stressful situations and that these characteristics became more pronounced as they got older. Mr Becroft said children suffering from material hardship were more likely to end up with a poor education and in crime when they grew up. "We know that long-term education is going to be a challenge. We know that they are, the kids, especially the boys, are at risk of criminal offending.”

Trust and community

People trust each other less in more unequal societies. Inequality has been found to undermine the sense of community. When a society becomes more unequal people’s lives are so different that a feeling of common citizenship becomes more difficult. Greater income inequality increases status competition and provides for the growth of mistrust and isolation.

More equal countries are also those that exhibit the highest levels of trust between their citizens. When it comes to maintaining trust between members of a community. As Eric Uslaner states in his book The Moral Foundations of Trust “what matters is not how rich a country is, but how equitable is the dispersion of income.” Members of unequal communities trust one another less and more unequal societies also suffer from higher rates of violent crime, in particular, higher homicide rates.

High levels of inequality undermine social solidarity. Egalitarians have argued that one of the most objectionable features of inequality is that it places individuals into separate social classes that are isolated from one another, are often locked into economic conflict, and lack any shared conception of the public good.

Research has shown that income inequality affects social trust, especially in the bottom half of income distribution. Social trust is an important prerequisite for achieving collective prosperity. Trust leads to a willingness and openness to interact with members of the community. In addition, trust reduces transaction costs. A high level of trust requires fewer checks and balances and as well as fewer resources to ensure the fulfilment of obligations. Countries with high social capital levels, which is strongly correlated with trust, have more efficient financial and labour markets.

The negative association of trust and inequality indicates that income and wealth differences play a part in community trust. Robert Putnam’s study of social capital, Bowling Alone, puts forward such a link between inequality and community wellbeing in the United States. Pudnam shows that his measure of “the high point of social connectedness and civic engagement” in the 1950s and 60s was also the period in which the United States had the most equal distribution of wealth. Conversely, Putnam argues that the growing inequality in the last three decades of the twentieth century coincided with a decline in social cohesion.

This was reinforced by the findings of Gould and Hijezn for the IMF where the increase in inequality in the United State between 1980 and 2000 explains almost half of the observed decline in trust in others. The report also found that increasing inequality has had a similar impact on trust in Government.

The impact of trust in institutions is supported by the United Nations Department of Economic and Social Affairs (UNDESA) in its 2020 World Social Report which states that “the increasing concentration of wealth and income affects trust in the role of politics and public institutions to address the needs of the majority.” The report found that a lack of trust destabilises political systems and hinders the functioning of democracy. While trust in institutions is necessary to address social issues, and to provide and distribute public goods collectively, it can be undermined if policy decisions are perceived to be unfair.

The report states that that “without appropriate policies and institutions in place, inequalities concentrate political influence among those who are already better off, which tends to preserve or even widen opportunity gaps. Growing political influence among the more fortunate erodes trust in the ability of Governments to address the needs of the majority.”

As we have seen in the United States since the 2016 presidential election campaign a lack of trust, in turn, can destabilize political systems and hinder the functioning of democracy. UNDESA has stated that “the recent resurgence of populism in some countries has also been presented as a direct consequence of rising inequality.”

Without appropriate policies and institutions, inequalities lead to a concentration of political influence among those who are already better off, and therefore tend to create or preserve unequal opportunities.

In conclusion reducing inequality does not have to come at the expense of economic growth. In fact improving inequality drives growth while improving wellbeing.

As New Zealand recovers from the impacts of COVID-19 it will be those who have the lowest incomes and wealth that will face the toughest challenges. Improving inequality will be a huge boost to these individuals, families and communities.

What is clear is that as we recover there does not need to be a trade-off between reducing inequality and increasing overall wellbeing. In fact the opposite is true. They are all interconnected. If New Zealand can address inequality we can improve wellbeing across all communities while also providing a boost to our economy.

Low interest rates and their contribution to inequality

In March, the Reserve Bank dropped the Official Cash Rate (OCR) from one percent to a record low 0.25 percent. Interest rate cuts at all major lenders have followed. The intention is to maintain confidence in markets. However, this has the potential to have a long term impact on home ownership and wealth inequality.

Property prices remained strong coming out of the national lockdown. According to realestate.co.nz the national average asking price increased by 12.9 percent from July 2019 to $756,250 in July 2020. However the total number of homes available for sale in July was down 11 percent on the same month in 2019. The strong performance of house prices is likely to slow as the full impact of COVID-19 is felt. This will be highlighted as the wage subsidy and mortgage deferral schemes end. Many expect that house prices could fall for the next six months with predictions of a price drop of anywhere from three to ten percent1.

While lower interest rates may make mortgage repayments on residential property more affordable, it does not mean that New Zealanders will be able to take advantage of the low rates to get onto the home-ownership ladder. A critical obstacle to getting onto this ladder for many New Zealanders is the relatively large (as a proportion of income) deposit required. This requirement has not been lessened by lower interest rates.

Although the Reserve Bank has slashed the OCR to encourage spending, banks have tightened their lending criteria. With unemployment almost certain to increase there will be redundancies of people across the entire income spectrum. Tough economic conditions will impact business performance. This will flow through to employees with many likely to experience lower incomes. The expected increase in unemployment and uncertainty brought about by COVID-19 has caused banks to reduce their risk appetite. In some parts of the country the location of the applicant has even become a factor in whether banks are willing to lend.

These impacts will likely make the ability to accumulate the deposit required to get onto the home-ownership ladder even more difficult for many.

With interest rates at an all-time low and banks reducing risk, it creates a situation where the housing market again benefits the wealthy at the expense of the less well off as explained later. This continues a long term trend of housing consolidating amongst less and less of the population. In 1991, almost three-quarters of households lived in a home that they owned. By 1996, this figure had decreased to 70.7 percent, was 64.8 percent in 2013 and 64.5 percent at Census 2018.

A consequence of low interest rates is that saving becomes unattractive and borrowing becomes more popular. This borrowing needs to find a home, and given the success property investors have had, property appears to be a safe place to look. Even with falling prices expected in there short term the long term trend has been for increasing house prices.

The attractiveness of residential property as an investment during the financial downturn is supported by the views of the public. New Zealanders remain optimistic about prices in the housing market, according to a recent Trade Me Property survey. As reported by stuff.co.nz in July almost two-thirds of survey respondents expected property prices to increase or remain the same in the last quarter of 2020. However, about one-third of Kiwis expected to see house prices fall once the wage subsidies end.

The long term security offered by housing is attractive to investors at a time of uncertainty. To put the recent security of housing as an investment into perspective the median house price in April 2020, through the majority of alert level four, increased from $640,000 in February to $680,000. Although the median price fell to $620,000 in May 2020 this was still 2 percent greater than the median price this time last year, October 2019.

Land isn’t going anywhere (unless the property is on the coast), meaning capital gains in the long term. Those with money, a down payment and good credit make for attractive customers to lenders. This benefits the well-off who have the ability to save for deposits. Some investors will also have considerable equity in existing property or investments that they can offer as security which is not possible for first time buyers. Backed by greater financial security these investors have the potential to pay higher prices than everyday households who stretch themselves looking to get into their first home.

Astute investors can leverage off their other assets to obtain interest-only mortgages, use the rents to remain cash flow positive and wait while capital gains accrue to them. Property investing is likely to remain attractive, even though recent law changes have strengthened tenants’ rights and protections.

In the long term this is likely to result in increasing inequality. Those already wealthy increase their housing assets and further improve their wealth situation (while also not paying tax on any gains). This occurs at the expense of those who are unable to access the housing ladder and the opportunities that go with a secure housing situation. Indeed, they are also likely to be already the most vulnerable to the negative impacts of COVID-19 at the start of the outbreak of the pandemic.

A further danger lies is if current home owners are unable to make repayments due to difficulties brought about by COVID-19 and are forced to sell their house. With investors looking for opportunities this will further move housing assets to the wealthy. The tenant who would otherwise have owned the home but for the impact of COVID-19 now pays rent to the investor rather than repaying their own mortgage. Further increasing the level of wealth inequality.